Leading role of Europe’s emerging countries in the reorganisation of global supply chains

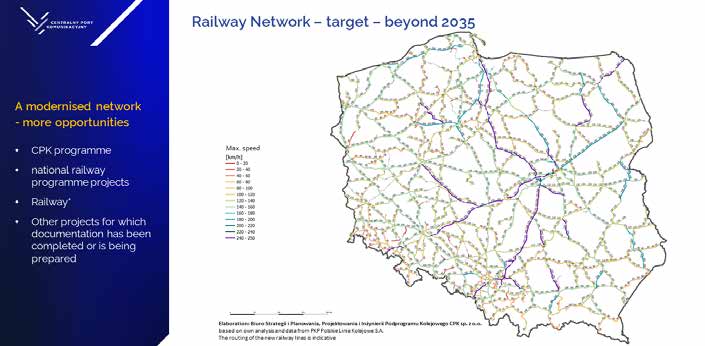

It is not a secret that one of the main challenges holding back growth in the CEE region is the delay in the development of transport infrastructure in many former Eastern Bloc countries, resulting from decades of insufficient investment. In Poland, after the period of socialism, and despite the fact that the railways were an integral part of the national transport system, it was subject to gradual degradation due to a lack of investment, and it was only after Poland joined the European Union that it began to be slowly rebuilt. Despite the fact that – as a country – Poland is still behind Western or Southern European countries in terms of the development of High Speed Railways (HSR), Poland can already be proud of the hundreds of kilometres of modernised railway lines, which have been equipped with most modern signalling solutions meeting European ERTMS/ETCS Level 2. Today, the driving factors behind the development of rail infrastructure in the region are the Centralny Port Komunikacyjny (CPK) project, Rail Baltica and the HSR development projects planned and implemented in the Czech Republic.

Transport infrastructure investment to boost CEE economic development

The European Investment Bank (EIB) emphasises the importance of filling the gaps in the Central and Eastern European transport system for the development of the region, creating significant economic benefits and at the same time enhancing the security of the continent. Key infrastructure projects to be implemented in the Central and Eastern European region remain CPK, Rail Baltica and the HSR development projects, planned and implemented by the Czech rail infrastructure manager, Správa železnic. The first of these are to link the rail networks of the other two and, as a result, create a comprehensive high-speed rail network in the region with transcontinental connections provided by the new CPK airport in central Poland.

According to the report “Benefits of HSR development and integration between EU countries of the 3Seas Initiative”, developed by Steer, an international consultancy that performs analyses for the European Commission, and presented recently in Warsaw during the international Railway Direction Days congress, the completed HSR network in the Three Seas region, suitable for passenger and freight transport, will be approximately 4,500 km by 2050. The total cost of developing the entire HSR network in the Three Seas region should be around EUR 60 billion. These investments should quickly bring benefits that are estimated to be close to EUR 120 billion. This means that, in the long term, the developed HSR network in the Three Seas region should generate twice the economic value compared to its initial cost (Economic Net Present Value – ENPV).

Railway investments in the CEE and the Three Seas Region

In the second half of January, Centralny Port Komunikacyjny Sp. z o.o., the Rail Baltica central project coordinator and joint venture RB Rail AS and Správa železnic, státní organizace, the national railway infrastructure manager in the Czech Republic, signed the Memorandum of Understanding to lay out the cooperation principles and further steps in strengthening cooperation for the development of high-speed rail in the region.

Through this tripartite agreement, the parties formalised a commitment to work together to develop high-speed rail projects nationally and across borders, ensuring further exchange of knowledge and experience in various areas of high-speed rail development, such as traffic forecasting and modelling, identification of new opportunities, joint planning timetables and alignment of preparatory work, investment models, and planning and organising joint activities to promote high-speed rail at EU and international levels.

“This is the unique, one-of-a-kind time in our common history when, functioning together in the region, we can create an unrivalled rail transport offer. We are drawing lessons from HSR investments in the West, and as a result our projects can bring about an economic domino effect, giving a boost to other industries and sectors,” Mikołaj Wild, CEO of CPK, said.

However, international cooperation in the development of a common rail transport system for CEE is not only about the Three Seas region. At the same time CPK has signed a cooperation agreement with Ukrainian Railways (Ukrzaliznytsia) aimed at the joint preparation of a feasibility study for the planned new railway lines between Poland and Ukraine. It identifies the construction of a HSR line on the Warsaw–Lviv–Kiev route (an extension of CPK railway spoke 5 to Lviv, and ultimately to Kiev) in the European standard, i.e., 1435 mm gauge with an assumed maximum operating speed of 250 km/h.

“This is a historic moment. Together with Ukrainian Railways, we are starting joint work on the Warsaw-Lviv-Kiev HSR line. The shortest route from Ukraine to the EU goes through Poland and CPK,” Mikołaj Wild, CEO of CPK, said.

CPK and Ukrainian Railways will jointly seek opportunities to obtain EU funding for the planned lines. EU standards for the design, construction and maintenance of railway infrastructure, including signalling and GSM-R, are to be implemented within the partnership. In the future, both parties also agreed to jointly develop a management model for the constructed lines.

At the same moment CPK has declared its readiness to exchange knowledge and experience, and to transfer its technical standards of the HSR, as well as the Passenger Transport Model, which is one of the modern tools used by the company to plan railway investments within the CPK transport development programme.

Traffic forecasts crucial for CPK investment plan

While implementing the investment plan, CPK not only cooperates extensively with science, but also creates and develops on its own tools necessary for forecasting domestic and international traffic, such as the Passenger Transport Model (PMT). PMT is a 4-step cross-industry model, thus covering different modes of transport, giving the possibility to take their complementarities into account. It also allows for analyses of the competitiveness of rail transport versus road or air transport. Thanks to this, an important feature of the model is the possibility to analyse passenger flows in public transport compared to the forecasted volume of individual road traffic. This, in turn, allows for a reliable and consistent forecast for Poland of the expected changes that will be brought about by the implementation of investments related to the construction of CPK. As the forecasts show, the increase in the number of people travelling by rail indicates that the investments by CPK are in line with the objectives of the European Green Deal. The Passenger Transport Model is already used by 40 institutions from various countries.

Framework for a reliable traffic forecast

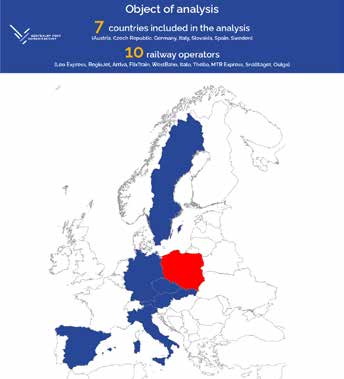

With a view to preparing a solid basis for traffic forecasts, CPK experts analysed the transport offer of “open access” operators in selected European countries, together with an assessment of their potential in Poland. The report developed on this basis summarises the experience to date of European Union countries in liberalising rail passenger transport and forecasts what will happen to Polish railways in the coming years, following the entry of other railway operators and the successive commissioning of new high-speed railway lines. Changes in access to the Polish railway infrastructure were initiated by the adoption of the ‘4th Railway Package’, i.e., solutions aimed at unifying railway services across the European Union.

The implementation of the 4th Railway Package in European Union countries makes it impossible for transport providers to procure transport services on a ‘negotiated’ basis and requires operators to be selected through competitive tender procedures. The 4th Railway Package also reinforces the idea of ‘open access’. This is based on the fact that any operator, once it meets the relevant criteria, can transport passengers on a route where it sees it appropriate to do so.

The implementation of the 4th Railway Package in European Union countries makes it impossible for transport providers to procure transport services on a ‘negotiated’ basis and requires operators to be selected through competitive tender procedures. The 4th Railway Package also reinforces the idea of ‘open access’. This is based on the fact that any operator, once it meets the relevant criteria, can transport passengers on a route where it sees it appropriate to do so.

“The construction of the high-speed railway (HSR) is an opportunity to change the image of railways in Poland. CMK Północ, i.e., the extension of the Central Railway Main Line to Gdańsk, or the construction of the “Y” line, i.e., the new line between Warsaw, Łódź, Wrocław and Poznań, will make it possible to offer travel times that are competitive with road transport as well as air transport,” says Bartłomiej Morga, a railway specialist at CPK and the main author of the report. “This report is an attempt to answer questions about what challenges the railway industry may face in the coming years, and at the same time it is an analytical basis which can be used to develop a target model for the organisation of transport.”

This CPK report is the first such comprehensive material on the liberalisation of the railway sector in Poland. The first part of the almost 250-page document contains an analysis of the experience of seven foreign markets: Germany, Sweden, the Czech Republic, Slovakia, Austria, Italy and Spain. The authors analysed the individual European countries in terms of the layout of railway connections, transport policy or barriers for operators.

High-speed rail to set new travel trends in Europe

Italy is an example of a country where opening the market has completely changed the perception of long-distance rail. The jump in terms of supply combined with attractive journey times has resulted in a rise in the number of passengers travelling by high-speed trains from 8.5 to 60 million in a decade. In 2019, passengers travelling between Rome and Milan could choose between 82 different trains, while back in 2009 it was about 35 trains. During peak hours, trains from the two competing operators (state-owned Trenitalia and private NTV) ran between Lombardy and Lazio as often as every five minutes. According to the research conducted by Italian experts specializing in the analysis of the domestic HSR market, this enabled the motorways to be relieved of some 10 million vehicles.

The same analysis shows that already in 2018, a decade after several hundred kilometres of high-speed railway lines were put into service, researchers looked at the structure of the travellers on these trains. They discovered that the largest group of 44% were passengers taken over from other modes of transport. A slightly smaller group, of 40%, were passengers who were travelling on the chosen route for the first time. The remaining 16% were passengers taken over from trains running on conventional infrastructure. This study shows just how numerous the group of potential new passengers choosing rail travel might be.

In Spain, a different model for long-distance transport has been developed in recent years. For key HSR lines, framework agreements were concluded with three operators. The plan was to ultimately increase the connectivity saturation of the three corridors: Madrid – Barcelona, Madrid – Valencia/Alicante and Madrid – Seville/Malaga by a target of 60% by 2019. Already in the first year of the agreement, during which the state-owned Spanish carrier Renfe began to compete on the Madrid-Barcelona route with France’s Ouigo, has resulted in a significant increase in traveller interest. Operators have declared almost 100% occupancy on trains, while ticket prices, compared to 2019, have decreased.

“Spain has developed an interesting concept which, unlike in most countries with liberalised markets, involves the signing of framework agreements between the infrastructure manager and a number of operators selected in a tender, specifying in advance the maximum number of trains they can run in a given period. This is an advantageous solution both for the infrastructure manager, who, by determining the number of slots to be handed over, can better plan maintenance, and for the operator, who, receiving a guarantee of access to tracks for 10 years, for example, is able to purchase modern rolling stock without the risk of having nowhere to use it. We are looking at this model with great interest,” Bartłomiej Morga said.

HSR development and Poland’s rail liberalisation

The liberalisation of the Polish railway market, the opening of HSR lines and the possibility of separating part of the traffic should lead to a clear increase in the use of the railway transport, according to the report. Thanks to competition among railway operators, there will be a reduction in ticket prices, which will have a very positive impact on the number of passengers, although the scale of that effect in Poland depends on a number of other factors described in the report. In light of EU commitments, the complete liberalisation of the railway market in Poland should take place by 2030.

The routes included in the study take into account the expansion of the national railway network that is being developed by CPK, projected using the Passenger Transport Model and then verified in terms of their commercial potential and the determination of the maximum traffic on each corridor.

The report developed by CPK was created as part of the first stage of the Horizontal Timetable project, which aims to develop an integrated timetable for the entire country. It is based on similar solutions implemented in the Czech Republic, Austria and Germany. The project takes into account the investment plans of CPK, but also of PKP Polskie Linii Kolejowe and other rail infrastructure managers in Poland. On the basis of these, it assumes the development of a transparent and consistent offer to increase the competitiveness of rail transport.

CPK meets region’s needs for further development and increased security

CPK is considered to have one of the most ambitious infrastructure projects in Poland’s history and is a key element of the wider Central and Eastern European development plan. Designed to effectively integrate air, rail and road transport, CPK’s multimodal transport hub, supported by a modernised and expanded rail and road network, should put Poland among the best-connected places in Europe and give it the potential to become a strategic transport hub for the entire CEE region.

Moreover, Russia’s war with Ukraine has made us realise how important it is to invest in railways in Central and Eastern Europe. Whatever solution Europe ultimately chooses, Poland will play a key role in connecting Eastern and Western Europe’s railways. The new CPK transport hub in Poland could be the key to solving major mobility problems. The movement of forces within TEN-T is currently severely hampered by missing or incompatible infrastructure. To overcome these barriers, the next Connecting Europe Facility (CEF) proposes co-financing dual-use (civil-military) transport infrastructure projects. The revision of the TEN-T network, most likely coming into force in mid-2023, will confirm the military operational capacity of CPK.

Share on: